THE EVER-GROWING REAL ESTATE PRICES IN KENYA

TRENDS IN LAND PRICES IN KENYA

- Nairobi's land prices are reported to be the most expensive in Africa.

- A market report by real estate firm–Hass Consult shows the average value for land in Nairobi suburbs has gone up from Sh30.3 million in December 2007, to Sh191.3 million in March 2022.

- As of March, this year, Upperhill had the most expensive land at Sh500 million while Ruaka prices are now at Sh92 million per acre.An acre in Westlands is going for an average Sh435.5 million, Kilimani(Sh406 million) while Kileleshwa area is at Sh304.7 million.

- In satellite towns, the average value for land has increased 10-fold from Sh2.4 million per acre in December 2007 to Sh24 million in March 2022. Ruaka has the highest at Sh92 million pr acre with areas such as Syokimau selling at Sh24.6 million. In Kiambu, an acre is Sh39 million.

- The Hass Consult findings of the report are in line with Cytonn Annual Markets Review 2021, which highlighted that the Nairobi Metropolitan Area land sector record

- REASONS FOR THE APPRECIATION OF LAND IN KENYA

- The implementation and conclusion of vast infrastructure projects promoting accessibility and opening up areas for Real Estate investments, this causes land to appreciate over time

It was also driven by efforts by the government to improve land transactions facilitated by the launching of the National Land Information Management System (NLIMS).

At the same time, Kenya's relatively high urbanization and population growth rates of 4.0per cent per annum and 2.3 per cent per annum. The performance was against the global average of 1.8 per cent and 1.0 per cent, thus driving increased demand for development land.

Credit advanced to sector, the reports were on the back of a finding that gross loans advanced to the Real Estate sector increased by 3.2 percent.

With a rapidly growing population and more so, an increasing middle class, increasing purchasing power creating sustained demand for development land, the residential sector has recorded the highest demand with the nationwide housing deficit standing at 200,000 units annually and an accumulated deficit of over 2 million units.

Digitization of the Lands Ministry- In May 2020, the Ministry of Lands and Physical Planning issued a notice to the public inviting them for public participation on the regulatory impact statement for the proposed Land Transactions (Electronic) Regulations 2020. Currently the ardhi sasa system is running for Nairobi County as pilot.

LAND USE CHANGES, with population growth and growth of urban areas, we’ve seen areas that have been previously marked for agricultural purposes being transformed to commercial and for residential purposes. Agricultural land is of generally lower value but when the utility changes, the value of the land increases.

INTEREST RATES, Low interest rates on mortgage loans translate to an excess of money in supply which can fuel the rate of home ownership as loans become cheaper. Being a free market driven by the forces of demand and supply, the high demand will result in rising property prices.

GENERAL INFLATION, inflation costs drive the price of building inputs like cement, steel and skill labor up, making construction projects more expensive. This makes properties more expensive.

LOCATION, still on the demand and supply factor, people will want to live in places near their areas of work. In urban areas, residential areas which are located near places of work have a high demand among the working class which in turn drives the prices for rental units.

NETWORK EXTERNALITIES, once a location becomes popular with residents, it becomes a hotbed for several social activities. Hobby classes, restaurants, shopping malls, multiplexes etc. start operating in that area. This suits the lifestyle of many people and hence the properties in this residential market start trading at a premium. The more developed a location becomes, the more people want to live in it and prices continue to rise.

VALUE ADDITION,

land also falls under value addition assets, that can multiply profits overtime. After buying land you can decide to add its value by either farming, opening a ranch or even building rentals or houses for sale. This is guaranteed added profit from the initial price that you bought the land fored an average annualized capital appreciation of 2.8 per cent in the 2021 financial year.

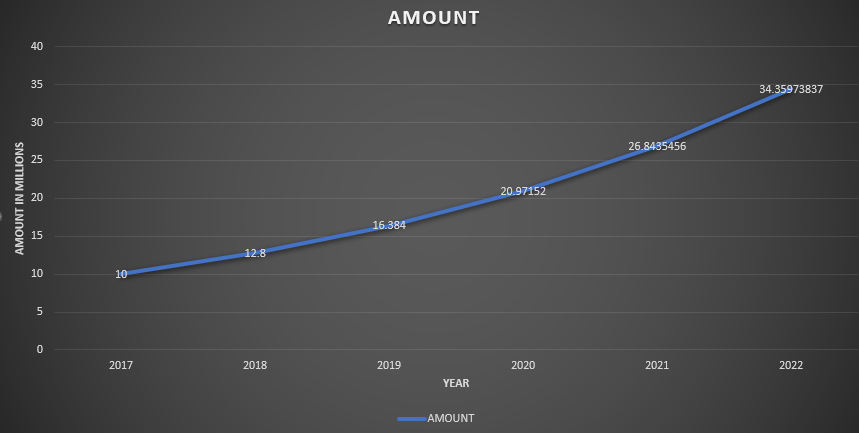

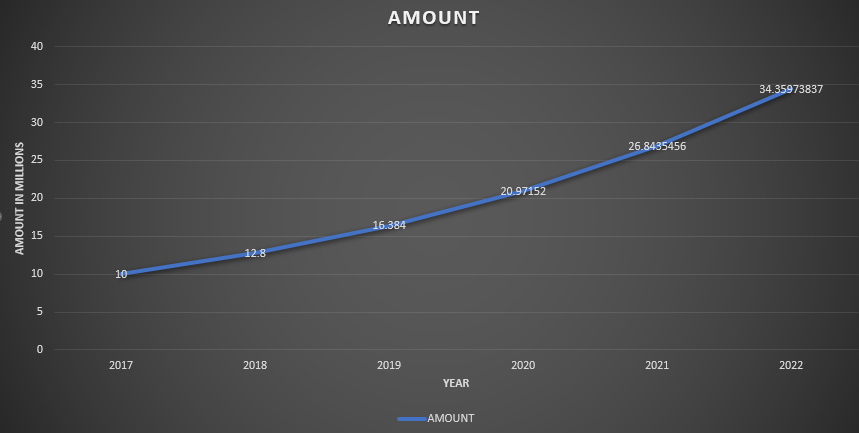

Hypothetically this appreciation can be represented graphically as follows, giving a arbitrary value of 10M per acre initially: